View Transaction Details

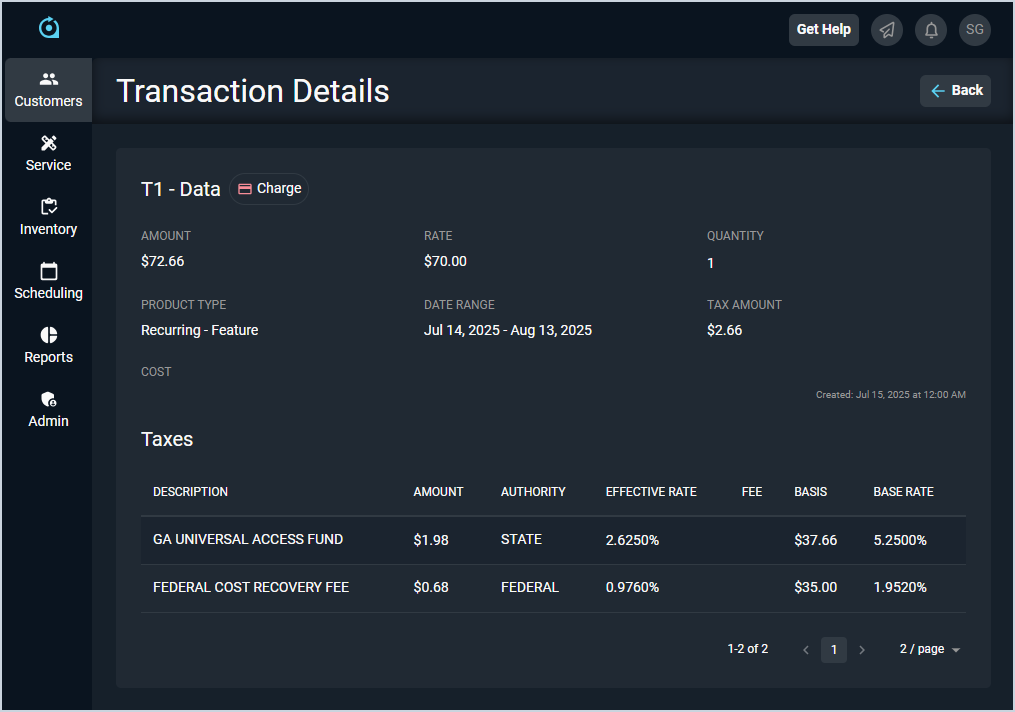

Clicking any line item or clicking the ellipsis menu at the end of any row on the Customer Profile Unposted or Ledger tabs opens the Transaction Details screen, allowing you to review the details of the transaction, including any taxes applied. Currently, the Transaction Details screen is only available for Charge or Credit Type transactions.

Each field on the Transaction Details screen is defined below.

| No. | Label | Definition |

| 1 | <Description> | Description of the transaction. |

| 2 | <Type> | Type of transaction. The Transaction Details screen is only available for Charge or Credit transactions. |

| 3 | Amount | Total amount for the transaction, including applicable tax. |

| 4 | Rate | Initial amount for the transaction, before tax or quantity was applied. |

| 5 | Quantity | Quantity of the product included in the transaction. |

| 6 | Product Type | Type of the product included in the transaction. |

| 7 | Date Range | Date range during which the transaction was billed. |

| 8 | Tax Amount | Total amount of all aggregated taxes on the transaction. |

| 9 | Cost | Amount that it costs your company to provide the product included in the transaction. |

| 10 | Created | Date and time the transaction was created. |

| Taxes | ||

| 11 | Description | Description of the tax applied to the transaction. |

| 12 | Amount | Amount in dollars and cents of the tax applied to the transaction. |

| 13 | Authority | Authority for the tax added to the transaction. Authority options include City, State, Federal, etc. |

| 14 | Effective Rate | Effective rate by tax partner applied to the transaction. |

| 15 | Fee | Fee added to the transaction. |

| 16 | Basis | Portion of the total transaction that is subject to tax. |

| 17 | Base Rate | Base sales tax rate for the transaction or specific product. |

The following actions are available on the Transaction Details screen.

- Sort the results in the table by clicking the column label in the table header.

- Return to the tab where you accessed the Transaction Details screen by clicking the Back button at the top of the screen.