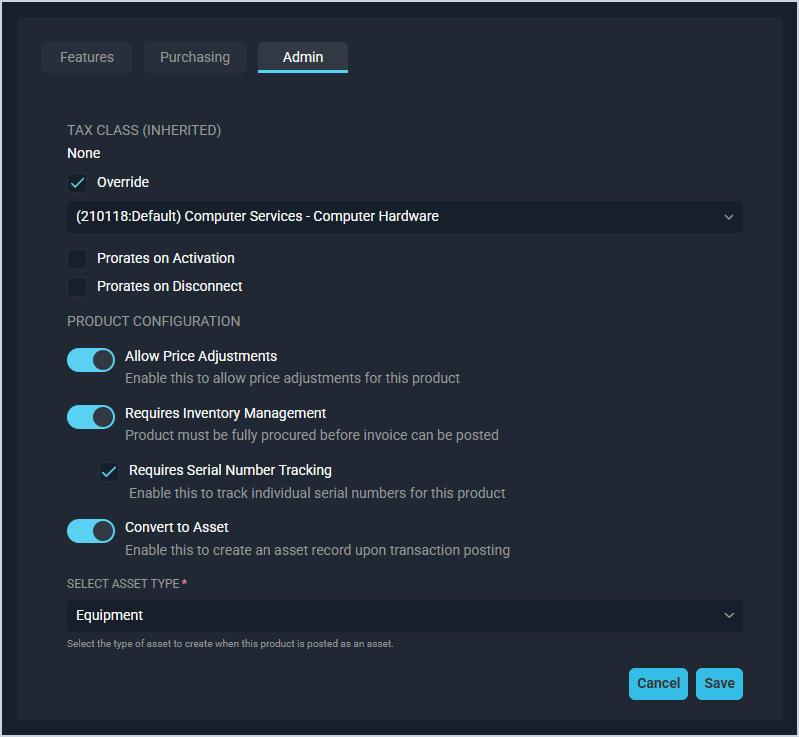

Product Details: Admin Tab

The Product Details screen allows you to view all relevant details for individual products, including description, type, price, cost, and provider. The Admin tab contains information about managing taxes for the product, including tax class and G/L code.

Each field on the Admin tab is defined below.

| No. | Label | Definition | |

| 1 | Tax Class (Inherited) | Tax class of the product. The Tax Class is inherited from the Product Type selected on the product. | |

| 2 | Override | Click to override the inherited tax class and select a different tax classification from the dropdown. See the Taxation Overview article in the Rev.io Billing Help Center for more information about configuring and overriding tax classes. | |

| 3 | Prorates on Activation | Click to prorate the product for the month it is activated for the customer. This field displays if the product has a Recurring Product Type. | |

| 4 | Prorates on Disconnect | Click to prorate the product for the month it is disconnected for the customer. This field displays if the product has a Recurring Product Type. | |

| 5 | G/L Code | General ledger (G/L) code for the product. This field can be used to create a customizable product category list for reporting purposes. This list is configured in Rev.io Billing under Settings > Drop Down Editor > Product G/L Code. | |

| 6 | Allow Price Adjustments | Click to allow price adjustments on the product, like discounts or markups. | |

| 7 | Requires Inventory Management | Click to enable inventory management on the product. This field displays if you have inventory management enabled in your instance. See the System Settings: Inventory article for more information. | |

| 8 | Requires Serial Number Tracking | Click to enable serial number tracking on the product. This field displays if you select the Requires Inventory Management option. | |

| 9 | Convert to Asset | Click to automatically create an asset for the customer when a transaction containing the product is posted.

| |

| 10 | Select Asset Type | Select the type of asset to create on the customer account when a transaction with this product is posted. This field only displays if Convert to Asset is enabled. |

Areas on the Product Details Screen

For information on the other areas of the Product Details screen, see the related articles.